Crypto Adoption: The Digital Money Revolution Taking Over the World

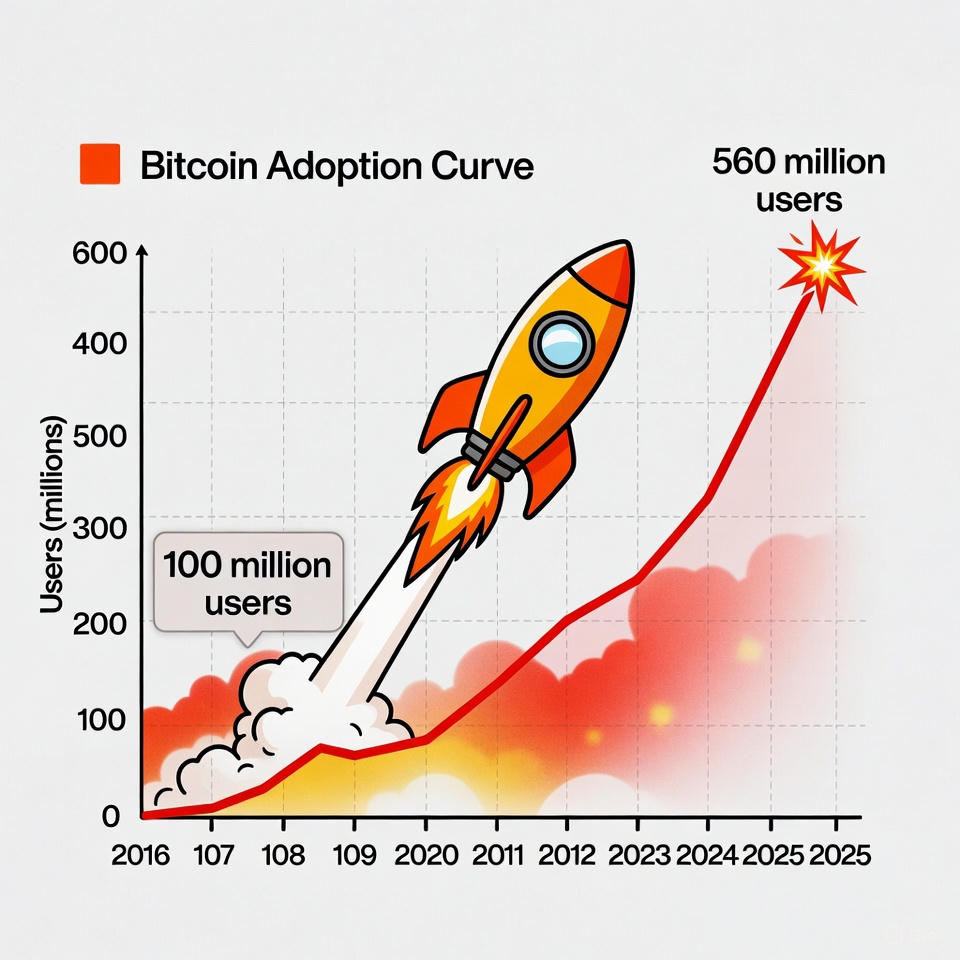

There were about 5 to 10 million crypto users around the world in 2016, most of whom were early adopters trying out Bitcoin. That number rose to about 35 million by 2018, thanks to media buzz and rising prices. The real growth happened between 2018 and 2020, when the number of users almost tripled to more than 100 million. This growth happened because apps were easier to use, there were more exchanges, and people were looking for other options during times of economic uncertainty.

The Boom Era: 2021-2023

The 2021 bull market supercharged adoption. User numbers doubled to around 200 million, driven by NFT hype and celebrity endorsements. In 2022, despite a market dip, growth continued to about 300 million owners, as institutions like companies started holding Bitcoin in reserves. By 2023, global crypto owners reached 420 million, a 33% increase from the previous year. Developing regions led the charge, using crypto for remittances and dodging inflation.

Surging into the Present: 2024-2025

By 2024, ownership had grown by 32% to 560 million, up from 425 million in 2023. The global rate was 6.8%. By 2025, there will be 559 million users, which is a 9.9% adoption rate among people who use the internet.

Active users, on the other hand, stay between 40 and 70 million, which shows that a lot of people hold crypto without trading it every day.

In early 2025, US activity alone jumped by 50% compared to 2024.

In the US, the percentage of adults who owned a home went from 15% in 2021 to 40% in 2024, then dropped to 28% (65 million people) in 2025. It went up from 2% in 2018 to 17% now among investors.

Top Countries Leading the Charge

With 25.6% of its internet users owning crypto, Turkey is at the top of the list. Next is Brazil with 20.6%, then South Africa with 19.6%, Nigeria with 19.1%, and Argentina with 18.8%. Vietnam has 21% of the market share in Asia, while the Philippines has 13%. These countries use cryptocurrencies for everyday things, like making payments in unstable economies.